Options strategy covered call

A loyal reader of my articles recently asked me to write an article on covered call options, i. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. Nevertheless, in this article, I will analyze why investors should resist the temptation to sell covered call options.

First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. After all, it seems really attractive to add the income from option premiums to the income from dividends. SPY remained essentially flat.

If they choose a higher strike price, the premiums will be negligible. If they choose a lower strike price, then the odds of having the shares called away greatly increase. The table below shows the current stock prices of some dividend aristocrats, namely Coca-Cola NYSE: KOAltria NYSE: PGWal-Mart NYSE: WMTMcDonald's NYSE: MCD and General Mills NYSE: GISthe strike prices of their call options and the premiums they offer. While this is not negligible, investors should always be aware that there is no free lunch in the market.

Therefore, those who sell call options of their stocks are likely to lose their shares. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon.

Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. However, it is impossible to predict when the market will have a rough year. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Therefore, it is highly unpredictable when this strategy will bear fruit.

Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. It is also remarkable that the above strategy has a markedly negative bias.

More specifically, the shares remain in options strategy covered call portfolio only as long as they options strategy covered call performing poorly. Instead, when they rally, they are called away.

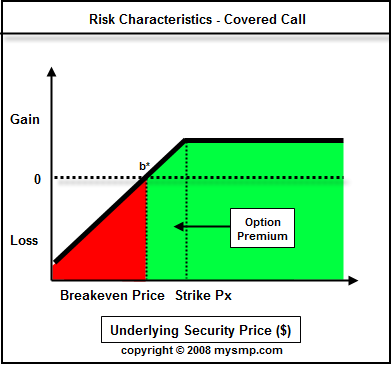

Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. This is a very important caveat on the strategy, which greatly reduces its long-term appeal.

Investors who prefer the stock best charts currency trading platform singapore from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock web bot stock market thanks to corporate America.

For instance, a company can keep growing for years and can thus offer excellent runecrafting how to make money to its shareholders.

Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium forex plan example its market price.

Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. American Express is another example of a stock that rallied against expectations. Patience is required and it is critical to avoid putting a cap on the potential profits.

To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally.

Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha.

Covered Calls

I have no business relationship with any company whose stock is mentioned in this article. Portfolio Strategy Fixed Income Bonds Financial Advisors Retirement Editor's Picks. Why You Should Not Sell Covered Call Options Mar. Summary Many investors sell covered calls of their stocks to enhance their annual income stream.

Covered Calls Explained | Online Option Trading Guide

However, this extra income comes at a high opportunity cost. Investors should not set a low cap on their potential profits.

Covered Call Options | Be an Option Seller and Earn Money by Renting Your Stock

Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here. Follow Aristofanis Papadatos and get email alerts.