Currency exchange rules india

Never miss a great news story! Get instant notifications from Economic Times Allow Not now. Choose your reason below and click on the Report button. This will alert our moderators to take action.

Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. ET APPS ET Android App ET iPhone App ET iPad App ET Wealth Android App ET Blackberry App ET Nokia App ET Markets Android App ET Markets iPhone App ET Money Android App.

FOLLOW US FACEBOOK TWITTER YOUTUBE LINKEDIN GOOGLE PLUS RSS.

Home Markets News Industry Small Biz Politics Wealth MF Tech. Jobs Opinion Blogs NRI Magazines Slideshows ET NOW ET Speed ET Portfolio. Real Estate RERA and You. Calculators IFSC Bank Code New Invoice Generator EPF Calculator House Property Income HRA Calculator Sukanya Samriddhi Calculator Education Loan Calculator Car Loan Calculator Home Loan Calculator Personal Loan Calculator Risk Tolerance Calculator Financial Fitness Calculator Tax Impact Calculator Homeloan Refinance Calculator Retirement Savings Calculator.

NIFTY 50 9, Select Portfolio and Asset Combination for Display on Market Band. Download ET MARKETS APP. Drag according to your convenience.

Government has extended the date of accepting old currency notes of Rs and Rs for certain categories till November It has been 10 days since government announced the demonetisation policy, one of India's biggest economic reforms.

The move has been praised by many, but its execution has faced many challenges. Considering the hardships being faced by cash strapped common man, who is finding it difficult to meet his daily needs without money, government has made multiple announcements since the first day, revising some key guidelines issues on day one. This is where we stand today, when it comes to norms around exchange of old currency , withdrawal of money from bank and ATMs.

Demonetisation a great move weakened by bad execution 1. You can get Rs 2, cash from select petrol pumps With a view to ease the rush at ATM's and banks, this move was initially suggested by the All India Petroleum Dealers Association.

The provision allows you to swipe debit card at a petrol pump run by state owned oil companies and get cash worth the value of transaction maximum Rs 2, The facility will initially be available at 2, petrol pumps across the country that have card swipe machines from State Bank of India, the country's largest bank.

Over the next three days, the acility will be extended to 20, outlets that have card swipe machines from HDFC Bank, Citibank and ICICI Bank. Withdrawal limit from a 'current account' raised to Rs 50, per week Considering the needs and requirement of business community, small traders, the government has raised the withdrawal limit from 'current account' to Rs 50, Weekly withdrawal limit from savings account increased to Rs 24, The weekly limit of Rs 20, for withdrawal from savings account has been increased to Rs 24, The maximum limit of Rs 10, per day on such withdrawals has been waived, so you can now withdraw up to Rs in a single visit to the bank.

Per day cash withdrawal limit raised to Rs 2, The government has raised the cash withdrawal limit from Rs 2, per card, per day to Rs 2, per card, per day.

This higher cash withdrawal limit is available only at recalibrated ATMs which will dispense one high security Rs 2, note and rest in the lower denomination. ATMs which have not been upgraded will continue to dispense Rs 2, per card. Cash deposits totalling Rs 2. Previously, the limit for cash deposit without PAN was Rs 50, per transaction.

A lot of people were depositing less than Rs 50, per day to escape the PAN provision.

Foreign Exchange Questions and Answers related to India

But later government issued a notification saying multiple deposits made between 9 Nov and 30 Dec will require a PAN if the combined sum exceeds Rs 2. This clarifies the misconception that one can deposit cash in multiple batches of less than Rs 50, each and escape mentioning the PAN.

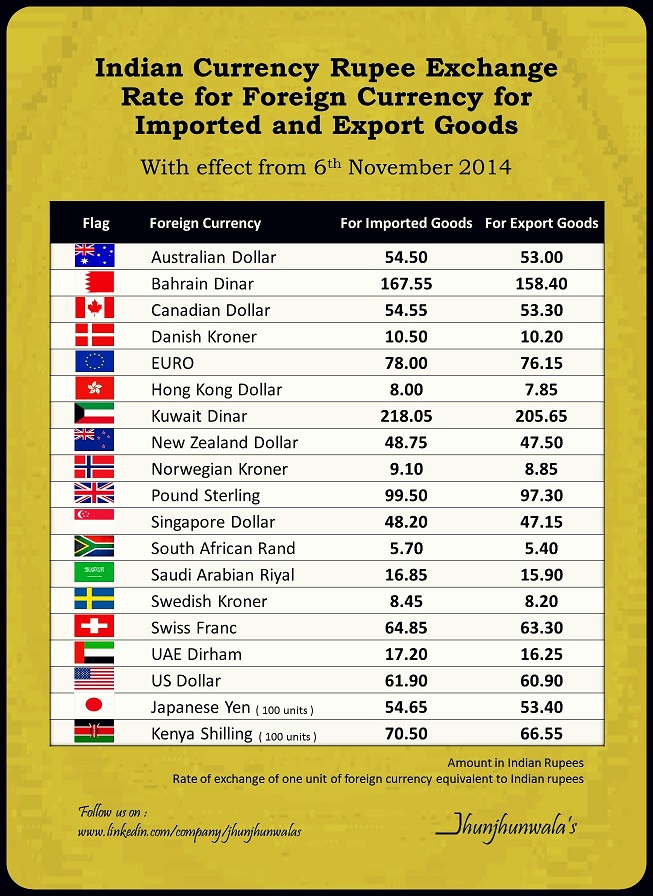

Foreign Currency Exchange - India

Exchange of old notes now only up to Rs 2, Government has reduced counter exchange of old Rs , Rs 1, notes from Rs 4, to Rs starting from today. Advance salaries for central government employees up to Group C level for Rs 10, Central government employees up to Group 'C' can draw salary advance up to Rs 10, in cash that'll be adjusted against their November salaries. Withdrawal limit of Rs 2,50, sanctioned for marriage purpose With a view to ease the hardships of those tying the nuptial knot, government has allowed up to Rs 2.

Old currency notes will also be accepted for making payment of utility charges for water and electricity, etc.

Foreign Exchange while traveling from India

Farmers allowed to withdraw up to Rs 25, per week against crop loans Government has allowed farmers to withdraw up to 25, rupees per week against their crop loans. Besides, it has also extedned the time limit to pay crop insurance premiums by 15 days.

Living and entertainment Timescity iDiva Zoom Luxpresso Gaana Happytrips Cricbuzz Get Smartapp Networking itimes MensXP. Hot on the Web UBER OnePlus 5 Top 10 mutual funds GST Sensex Gold rate today Sensex Today. Services ads2book Gadgetsnow Free Business Listings Simplymarry Astrospeak Timesjobs Magicbricks Zigwheels Timesdeal dineout Filmipop Remit2india Gaana Greetzap Techradar Alivear Google Play Manage Notifications. Digg Google Bookmarks StumbleUpon Reddit Newsvine Live Bookmarks Technorati Yahoo Bookmarks Blogmarks Del.

My Saved Articles Sign in Sign up. Find this comment offensive? This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

Your Reason has been Reported to the admin. Fill in your details: Will be displayed Will not be displayed Will be displayed.