Define short stock market

A short squeeze is a rapid increase in the price of a stock that occurs when there is a lack of supply and an excess of demand for the stock.

Short squeezes result when short sellers cover their positions on a stock, resulting in buying volume that drives the stock price up. This can occur if the price has risen to a point where short sellers must make margin callsor more loosely if short sellers simply decide to cut their losses and get out. This may happen in an automated manner for example if the short sellers had previously placed stop-loss orders with their brokers to prepare for this possibility.

Since covering their positions involves buying shares, the short squeeze causes an ever further rise in the stock's price, which in turn may trigger additional margin calls and short covering. The opposite of a short squeeze is the less common long squeeze.

This can also apply to futures contracts. From Wikipedia, the free encyclopedia. Retrieved 11 November Primary market Secondary market Third market Fourth market.

Common stock Golden share Preferred stock Restricted stock Tracking stock.

Selling short Definition - gyranasoreso.web.fc2.com

Authorised capital Issued shares Shares outstanding Treasury stock. Broker-dealer Day trader Floor broker Floor trader Investor Market maker Proprietary trader Quantitative analyst Regulator Stock trader.

Short (finance) - Wikipedia

Electronic communication network List of stock exchanges Opening times Multilateral trading facility Forex market hours of operation. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model.

Algorithmic trading Buy and hold Concentrated stock Contrarian investing Day define short stock market Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value investing.

Block trade Cross listing Dark liquidity Dividend Dual-listed company DuPont analysis Efficient frontier Flight-to-quality Haircut Initial public offering Margin Market anomaly Market capitalization Market depth Market manipulation Market trend Mean reversion Momentum Open outcry Public float Public offering Rally Returns-based style analysis Reverse stock split Share repurchase Short selling Slippage Speculation Stock dilution Stock market index Stock split Trade Uptick rule Volatility Voting interest Yield.

Retrieved from " https: Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history.

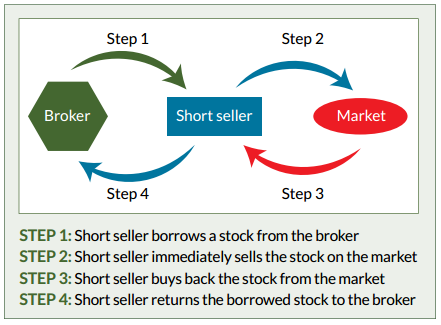

Short selling, explainedNavigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page.

Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page.

What is a short sale? definition and meaning

This page was last edited on 13 Decemberat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.