Trading options seminar

Michael Gross shows how to Bump Your Odds of Success with the Intercommodity Strangle.

Futures and options trading involves risk of loss and may not be appropriate for all investors. Only risk capital should be used. Home Why Sell Options? What is Option Selling?

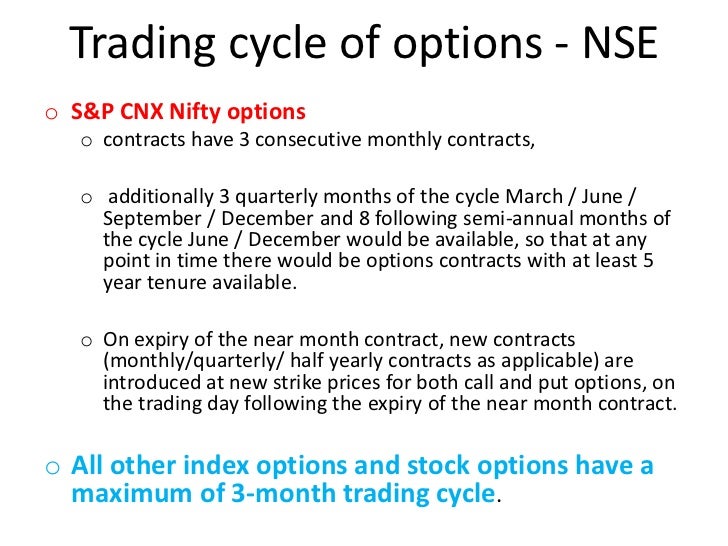

About Us Who is OptionSellers. Option Selling Seminar Page: Lessons from the Pros James Cordier and Michael Gross Explains Option Selling Concepts. Why Commodities over Stock Options?

How to Manage Short Option Margin.

Structuring Your Option Selling Portfolio. Example of Selling Deep out of the Money. How Does our Professionally Directed Account Work?

How To Avoid Over Positioning. How To Sell A Strangle. When To Sell Naked. Intro To Option Selling Part 1. The Strategy Of Selling Strangles.

Trading Concepts, Inc. | Mentoring E-Mini, Stocks, Forex and Options Traders for Life

The 3 Biggest Mistakes New Option Sellers Make. Selling Deep Out Of The Money Options.

Selling The Vertical Spread. How to Build a Premium Ladder.

How to Use Seasonal Tendencies in Commodities. Managing Risk On Your Short Option Position. The Submarine Method Of Managing Your Portfolio Risk. Taking Your Option Selling Profits Early.

Annual Chicago Options Seminar - gyranasoreso.web.fc2.com

Managing Your Option Selling Margin. How to Sell the Ratio Credit Spread. Fundamentals Of Agricultural Markets. How To Really Use Technicals. How to Pick the Right Option to Sell. How to get Real Diversification. Avoiding the BIG Hit. How to use a Margin Cushion.

Options Trading: Tools & Resources | Charles Schwab

Option Selling as a Business. Fixing A Broken Option Sale. Bump Your Odds of Success with the Intercommodity Strangle. Use it at your own risk. There is risk of loss in all trading.

Past performance is not necessarily indicative of future results. Traders should read The Option Disclosure Statement before trading options and should understand the risks in option trading, including the fact that any time an option is sold, there is an unlimited risk of loss, and when an option is purchased, the entire premium is at risk.

In addition, any time an option is purchased or sold, transaction costs including brokerage and exchange fees are at risk. No representation is made that any account is likely to achieve profits or losses similar to those shown, or in any amount. An account may experience different results depending on factors such as timing of trades and account size.

Before trading, one should be aware that with the potential for profits, there is also potential for losses, which may be very large. All opinions expressed are current opinions and are subject to change without notice. Terms of Service Privacy Policy. Gold Strangles Still Big Payers for Yield Seeking Option Writers.