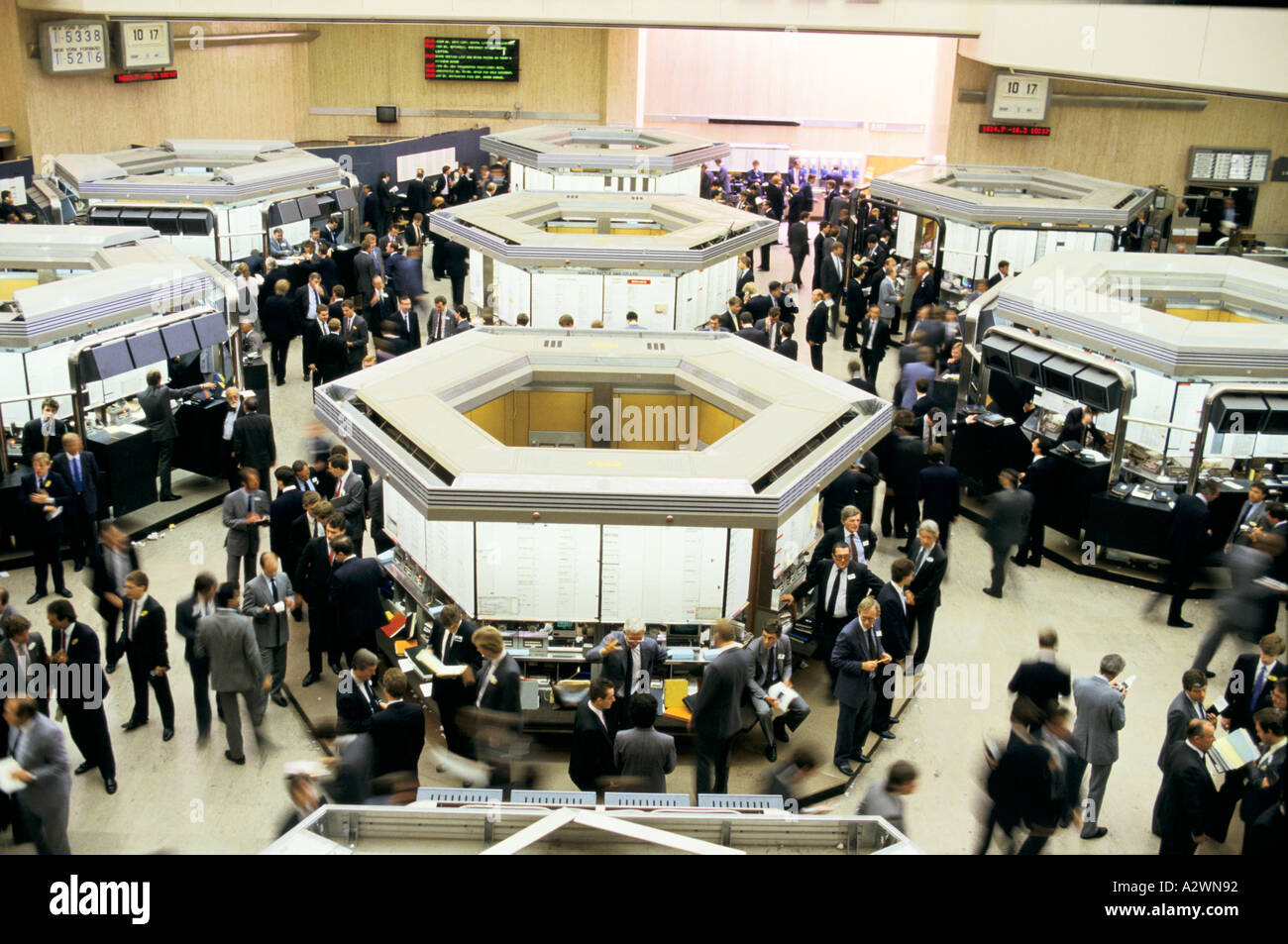

London stock exchange floor trading

Open outcry is the name of a method of communication between professionals on a stock exchange or futures exchange typically on a trading floor.

It involves shouting and the use of hand signals to transfer information primarily about buy and sell orders. In an open outcry auction, bids and offers must be made out in the open market giving all participants a chance to compete for the order with the best price.

New bids or offers would be made if better than previous pricing for efficient price discovery.

Exchanges also value positions marked to these public market prices on a daily basis. In contrast, over-the-counter markets are where bids and offers are negotiated privately between principals.

Since the development of the stock exchange in the 17th century in Amsterdam, open outcry was the main method used to communicate between traders. However, this started changing in the later half of the 20th century, first through the use of telephone trading and then starting in the s with electronic trading systems. As of few exchanges still had floor trading using open outcry.

As of most stocks and futures contracts were no longer traded using open outcry due to the lower cost of the aforementioned technological advances. Since the s the open outcry systems have been being replaced by electronic trading systems such as CATS and Globex. Floor trading is the meeting of traders or stockbrokers at a specific venue referred to as a trading floor or pit to buy and sell financial instruments using open outcry method to communicate with each other.

Open outcry - Wikipedia

These venues are typically stock exchanges or futures exchanges and transactions are executed by members of such an exchange using specific language or hand signals. During the s and s phone and electronic trading replaced physical floor trading in most exchanges around the world.

As of few exchanges still have floor trading. One example is the New York Stock Exchange NYSE which still executes a small percentage of its trades on the floor. That means that the traders actually form a group around the post on the floor of the market for the specialist, someone that works for one of the NYSE member firms and handles the stock. As in an auction, there are shouts from those that want to sell and those that want to buy.

The specialist facilitates in the match and centralizing the trades. On 24 January , the NYSE went from being strictly an auction market to a hybrid market that encompassed both the auction method and an electronic trading method that immediately makes the trade electronically.

A small group of extremely high-priced stocks isn't on this trading system and is still auctioned on the trading floor. Even though over 82 percent of the trades take place electronically, the action on the floor of the stock exchange still has its place.

While electronic trading is faster and provides for anonymity, there is more opportunity to improve the price of a share if it goes to the floor. Investors maintain the right to select the method they want to use. Since the s, Nymex had a virtual monopoly on 'open market' oil futures trading, but the electronically based IntercontinentalExchange ICE began trading oil contracts that were extremely similar to Nymex's in the early s and Nymex began to lose market share almost immediately. The pit-traders at Nymex had been resisting the electronic move for decades, but the executives believed the exchange had to move to the electronic format, or it would cease to exist as a viable business.

The executives introduced CME's Globex system into Nymex in Floor hand signals are used to communicate buy and sell information in an open outcry trading environment.

The system is used at futures exchanges such as the Chicago Mercantile Exchange. Traders usually flash the signals quickly across a room to make a sale or a purchase.

Signals that occur with palms facing out and hands away from the body are an indication the gesturer wishes to sell. When traders face their palms in and hold their hands up, they are gesturing to buy. Numbers one through five are gestured on one hand, and six through ten are gestured in the same way only held sideways at a 90 degree angle index finger out sideways is six, two fingers is seven, and so on. Numbers gestured from the forehead are blocks of ten, and blocks of hundreds and thousands can also be displayed.

The signals can otherwise be used to indicate months, specific trade or option combinations, or additional market information. These rules may vary among exchanges or even among floors within the same exchange; however, the purpose of the gestures remains the same.

From Wikipedia, the free encyclopedia. Hand signaling open outcry. Independent, The London ,. Can He Fix Merrill? Primary market Secondary market Third market Fourth market. Common stock Golden share Preferred stock Restricted stock Tracking stock.

Authorised capital Issued shares Shares outstanding Treasury stock.

London Stock Exchange - No trading floor? [Archive] - Straight Dope Message Board

Broker-dealer Day trader Floor broker Floor trader Investor Market maker Proprietary trader Quantitative analyst Regulator Stock trader. Electronic communication network List of stock exchanges Opening times Multilateral trading facility Over-the-counter. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model.

Algorithmic trading Buy and hold Concentrated stock Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value investing. Block trade Cross listing Dark liquidity Dividend Dual-listed company DuPont analysis Efficient frontier Flight-to-quality Haircut Initial public offering Margin Market anomaly Market capitalization Market depth Market manipulation Market trend Mean reversion Momentum Open outcry Public float Public offering Rally Returns-based style analysis Reverse stock split Share repurchase Short selling Slippage Speculation Stock dilution Stock market index Stock split Trade Uptick rule Volatility Voting interest Yield.

Retrieved from " https: Financial markets Nonverbal communication. All articles with vague or ambiguous time Vague or ambiguous time from September Use dmy dates from July Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page.

London Stock Exchange Trading Floor Stock Photos & London Stock Exchange Trading Floor Stock Images - Alamy

This page was last edited on 12 May , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.