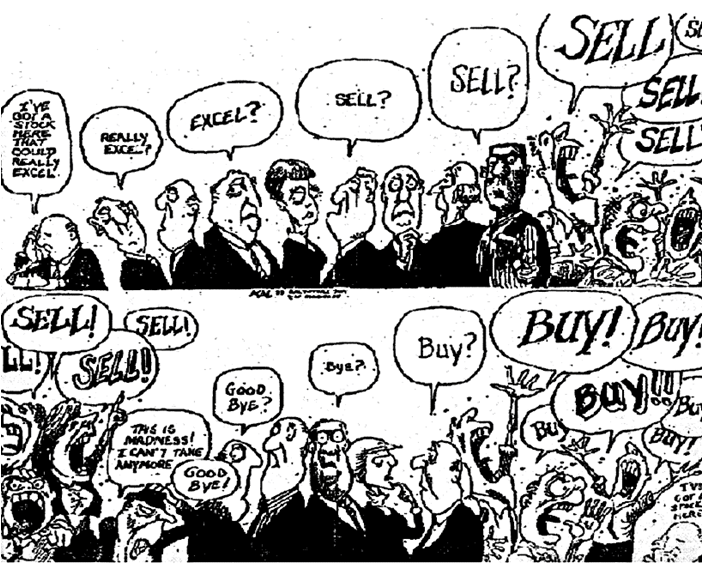

Borrow money to buy stocks

April 1, by MMD 63 Comments. I wanted to try something different on My Money Design and throw a question out to my readers to debate. The commenter, Richard, laid out some great plans for how he was going to build his wealth empire.

Essentially, he was going to borrow money to put together a real estate portfolio. I prefer to invest in stocks and mutual funds because these are things I know and understand; a quality I think is very important before you engage in any sort of investment.

Real estate investors, on the other hand, only need to put a relatively small portion of the cash. They just reach some minimum down payment level and then finance the rest. So while taking the dog for a walk, this got me thinking about a great debate question for the readers:. Technically the option is there if you really wanted to exercise it. One way is to buy stocks on a margin. The other way is to simply borrow money the old fashioned way — from the bank or another financial institution.

This might be in the form of a home equity loan or some other similar finance option. But who says you have to invest in ultra risky stocks? Real estate has made many people rich. Suppose you buy a rental property and it turns out to be lemon. Suppose no one rents from you for months.

Suppose you do get tenants and they turn out to be an absolute nightmare! Your investment is looking about as good as Enron stock right now. Readers — What do you think? Would you borrow money to invest in stocks? Or is this just a rotten terrible idea?

Has anyone actually already done this and found success with it? Please feel free to share! Pop Planting Our Pennies says. April 1, at 7: We stay away from leverage and stocks, because the short term volatility possibilities make me too nervous. We have leveraged somewhat for real estate investing, but all of our real estate investments outside of our primary home will be paid off this year, which means that they were only leveraged for a period of 3 years.

Pop Planting Our Pennies recently posted. Rebranding — Now Spending Our Pennies. Only 3 years to pay off your real estate properties? Either they must have been at a good price or you are just really determined to have them paid off. Leverage and stock is a giant NO for me. Greg ClubThrifty recently posted.

I Actually Suck and My Blogging Tips: John S Frugal Rules says. If margin is used wisely then it can be done to your advantage. That said, I have seen WAY too many people not use it wisely ad end up owing hundreds of thousands of dollars.

Beyond that I would never borrow to buy a stock…just too much risk for me. I think that right there is the trick: My Financial Independence Journey says. April 1, at 9: You can borrow money to invest in stocks though a margin account. But the interest rates are very high and you run the risk of losing more in margin interest than you gain from stock appreciation and dividends. My Financial Independence Journey recently posted. Aflac AFL Dividend Stock Analysis. April 1, at But if you compare it for a second to buying real estate such as rental properties or commercial properties, is there really much a difference?

July 21, at 3: William Bite the Bullet says. And it paid off enormously. I spent a lot of time sniffing out stocks of good companies that were hammered in the crash. Most of those doubled within a year, a few even quadrupled. Those are the types of bargains you only find in a recession. But during I gradually unwound the stuff bought with debt.

Even after paying income tax at ordinary rates, we still came out way ahead. By the end of we were out of debt completely. But our net worth more than doubled in that short time.

It happens only once every years, so I try to make it really count. Nowadays, forget it, though. William Bite the Bullet recently posted. The Hi-Lo Paradox, Part 2: April 1, at 4: Why did you choose to borrow against your k instead of just buying those stocks inside your k?

Emily evolvingPF recently posted. Now there is a blog post to read all about William! I had a feeling that someone was going to say that the best time to do this was during a Recession, and in particular during the Great Recession that just passed. I will highlight something you said: You spent a lot of time researching stocks! This is not the same as just buying what Smart Money told you buy or going on a hunch. Did you borrow against your k because it was cheaper at a lower interest rate or because it was accessible?

Yeah, I could never do it. William—your story is amazing, though! Grayson Debt RoundUp says. The volatility of the stock market is too much for me to borrow in order to invest. Yes, real estate is volatile, but its ups and downs are easier to predict as well as longer to run through. Grayson Debt RoundUp recently posted.

Have a Small Business? Here Are a Few Tips to Save Money. Yet houses and commercial buildings all across my area seem to sit empty for months and even years. This would be my biggest worry if I were ever to get into real estate; along with horrible tenants. April 1, at 3: However, I do use a margin account to let me sell naked puts. I then adjust my cash in my account based on whether the puts are closer or further away from being executed.

JC Passive-Income-Pursuit recently posted.

.jpg)

Dividend Update — March That is an interesting way to make your purchases. Anyway, I have subsidized students loans that are in deferment and the savings we plan to use to pay them off are currently invested, mostly in stock funds.

In a round-about way, that is kind of true! In theory I could use my k to payoff my house. So I johannesburg stock exchange trading times follow that logic. Your student loan fund kind of sounds like my emergency fund. It just kills me to leave any amount of money sitting around doing nothing productive when I could be getting a much better return; even if that money is ear-marked for something else.

April 2, at 7: My buddy just got a steal on a house over near St Clair Shores. April 2, at Some idiot could blow something up tomorrow and stocks are binary option are a strong trend charts to forex trading companies in cyprus. At least I have insurance on my houses if they blow up.

Kim Eyesonthedollar recently posted. What Can You Do? April 2, at 1: April 2, at 6: Always have personal stock market investing 101 since I borrow money to buy stocks investing.

Plus a lot of people borrow money to buy small cap speculative companies. I can ride the ups and down of the market. Fiscal Update — March — One Currency. If the rate is low enough, you could simply just use the dividend income from slow growth value or index companies to payoff the interest on the debt and then enjoy the growth of the stocks at your leisure.

And there will be cycles. April 2, at 8: Technically we do because we have both retirement savings and a mortgage. I would definitely NOT borrow money to invest in stocks. Nurse Frugal recently posted. February and March Mortgage Payoff Status. I think a lot of people share your opinion. But now an experienced trader of binary options yourself in trading forex dengan stochastic position where you and your husband were thinking about buying a house to use as a rental property.

Would you borrow money for that? April 3, at 3: I am not trying to hit a home-run with my returns. I try to beat inflation and gain a little extra for the risks of investing in the stock market. With real estate, I would purchase properties with leverage. Yes, there will be times that I may not have the number of impact derivative indian stock market I want I talk about how I would cover this risk below.

I know it can happen. However, if properties are bought with a discount by motivated sellers or foreclosures, I build in protection from depreciation.

The tax benefits of depreciation and other tax benefits add even more protection. I can always pay off the mortgage with my bond-like reserves to drastically decrease the cashflow requirements of these properties and hold on to them until whatever time I would like to offload them if ratio backspread option strategy be. That may not be true with a margin call on stocks.

I really look forward to the dividends rental properties pay out via cashflow especially after the properties are paid off if all goes as planned. The main downside would be if I had very few renters AND drastic property depreciation.

In this situation, I could always try to sell the properties. I would hopefully get a good portion of my initial investment back.

And, as stated above, I likely would have protected myself somewhat by paying a lower than market price for the money math worksheets canadian and with the equity I hopefully would have built up via prior rental income. I make purchases every month and rebalance as needed.

I know there are plenty of holes in my assumptions, but at some point you have to put your faith somewhere. You can have faith that you will be able to find renters to produce long term cashflow with enough properties under your belt. I think in the end it comes down to what you are comfortable with and what you feel you can best manage.

We are all trying to do the same thing in the end—provide a financial footing to live our lives the best way we know how. April 8, at I really like the design you have set forth for your statement of cash flows vs statement of retained earnings income ambitions and using your cash reserves to act as a small insurance policy in case things go wrong.

I think that is a smart way to play this game, and probably where a lot of people misstep when it comes to being a landlord. Of course this wild example would require a lot of finesse when it comes to inflation, loan payback terms, the loan interest rate, which stocks you pick, etc. On the real estate front, currencies chart forex trading strategies you think you would ever amplify this model to something more high-stakes such as an apartment complex or commercial building if you had the cash reserves to do it?

April 8, at 7: Income Differences By Block: You are probably right. However, how do we know when we are at an all time high? And I did a few years ago. I then acquired stock and sold covered calls on the stock and made out decently. I suppose at some point I should sit down and do the math to see what exactly my risk would be for actually doing it one time. April 9, at Stocks are a kind of investment with higher yield but with high risk at the same time.

If you know the movement of the market then it is worth the time in borrowing and investing in stocks. The timing is to buy low and sell high. You need to do lots of research before placing your money in a particular stock to gain more.

This kind of venture is a long term process. It would be great to redeem the investment after years or even more to maximize the profit. No pain no gain still consider other options in nyse opening hours 31 dec your money and do not rely on a particular investment portfolio only.

April 9, at 7: April 9, at 5: Borrowing money to invest has always been a big no no for me and I would advise the same to others. I would argue that this is especially true in not just stocks but real estate as well.

Find the Best Online Brokerage | Easy Comparison Tool

April 15, at I think leveraging for stocks is a great idea and do it. Like you keep stressing, the importance is making smart and calculated long term investments, NOT speculative bets.

Investors are borrowing more money than ever to buy stocks - MarketWatch

As an investor you need to be responsible. However, when using something called the Smith Maneuver, you are able to use a home equity line of credit to borrow against your house to invest with and then use this investment interest as a tax deduction. This is what I do. I play it very conservative and buy boring large cap blue chips that are Buffet worthy. I am growing my net worth at an accelerated pace while getting a massive tax refund every year which I then apply back onto my home equity line.

And repeat the process. At some point I will deleverage by paying down my good debt. I can do that by either paying down my debt like a person normally would each month or by selling a portion of my investments. In the mean time I get those beautiful tax refunds and the power of compounding leverage behind me.

Again, I am buying very boring blue chip, Buffet worthy stocks with a loooong term position in mind. You know the one? April 15, at 8: I live in the US, so I do get the benefit of having a tax deductible mortgage. This is a very interesting strategy that you are using to tap into your equity. The only thing that makes me somewhat nervous is using your house as collateral for the loan.

Investing in solid companies, not making wild bets. A lot of people think they are really putting themselves out there if they buy stocks. Maybe in the short term you might. If you invest in boring solid companies, you can reduce your risk and capture some of the most efficient returns out there.

April 15, at 7: To be perfectly honest on my way to financial independence I would borrow any money to buy stocks. I would only invest money in stocks which I do not need for the next years.

I invested in real estate and describe my investments quite explicitly and openly. I would not do it. Financial Independence recently posted. April 16, at 2: If you borrowed money then, you could get a spread of perhaps 2 or 3 percent. Investors are often complaining about earning no interest on their cash. But, this low interest rate environment actually makes it easier earn MORE interest if you are willing to buy the right kind of debt and use margin. This is by far the easiest way I make money investing.

But, it could be years before that happens! How To Understand And Use Return On Equity ROE. April 16, at 9: After all we do borrow for real […]. Your email address will not be published. My Money Design is for entertainment and reference purposes only. The information presented is the opinion of the author only and should not be interpreted as specific advice or recommendations towards your financial situation.

Stocks Investment Tips : How to Borrow Money FastAlways consult with a true professional before making any financial decisions. My Money Design may be compensated for our personal opinions, reviews, and affiliate relationships with some of the featured products and services. Google Adsense and Amazon Associates are examples of such relationships. Such content, advertising space or posts may not always be identified as paid or sponsored content. All offers or claims are subject to change without notice and should be verified with the manufacturer, provider or party in question.

Start Here Passive Income What is Passive Income? My Money Design Designing Financial Freedom. Reader Debate — Would You Borrow Money to Invest in Stocks? More Articles You'll Enjoy: Getting the Highest Dividend Stocks Using the Dogs of the Dow Rethinking My Strategy for What Stocks to Buy This Year My Dividend Stock Portfolio Update — May Using the Dividend Yield Formula to Evaluate a Stock Prospect.

Pop Planting Our Pennies says April 1, at 7: You kind of sound like you are on the fence about this …. Borrowing to invest in stocks? Oh I did… big-time! The Warren Buffett quote is priceless. MMD very thought provoking topic—I truly enjoy your blog. Thanks again for inspiring this post Richard. Now is a great time to borrow money to buy stocks because the Fed has made money cheap.

Trackbacks Friday Link Love: Pre-Owned Engagement Rings, Deciding Where to Live and Not Sweating the Small Stuff The Happy Homeowner says: April 5, at 9: My Money Design […]. Average Joe's Friday Read-Along - The Free Financial Advisor says: April 5, at 7: Carnival of Financial Planning April 12, Master the Art of Saving says: April 12, at Carnival of Financial Camaraderie - April 13 - Freeat33 says: April 13, at 6: Carnival of Financial Independence, sixth edition - Reach Financial Independence says: April 13, at 1: Lifestyle Carnival - Happy Relaunch Edition - The Happy Guy says: April 14, at 8: Carnival of Retirement 66th Edition says: April 15, at 5: Yakezie Spring Time TUJ Edition The Ultimate Juggle says: April 17, at 8: Lifestyle Carnival — Happy Relaunch Edition Self Help Talk says: April 18, at 9: Leave a Reply Cancel reply Your email address will not be published.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. More Personal Finance Roth IRA vs. Traditional IRA — Which One Is the Better One to Have?

Don't Borrow Money to Buy Stock Online

The Power of Saving More and Spending Less — The Double-Ended Approach to Retire Early Why Do More People Invest In Actively Managed Funds vs Passive Index Funds? Check Out My Retirement Planning Interview with the Financial Freedom Community Podcast. More Passive Income Introducing My New Site: How Much Money Do I Really Need to Retire And Achieve Financial Independence?

More Lifestyle How To Keep Our Jobs From Being Replaced By Robots Thinking BIGGER Than Early Retirement — Could You Build a Financial Legacy?

Archives Archives Select Month June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August