Stock market weekly outlook

Traditional Roth IRA Conversion RMD Beneficiary RMD How to Invest Overview Investing Basics Overview Set Your Goals Plan Your Mix Start Investing Stay on Track Find an Account that Fits Waiting Can Be Costly Saving for Retirement Overview How to Save for Retirement Retirement Savings Strategies: What's new Where are my tax forms?

You can do this in two ways:. You may send this page to up to three email addresses at a time. Multiple addresses need to be separated by commas. The body of your email will read: Sharing this page will not disclose any personal information, other than the names and email addresses you submit.

Stock Market Futures Weekly Trend Outlook – March 6 | See It Market

Schwab provides this service as a convenience for you. By using this service, you agree to 1 use your real name and email address and 2 request that Schwab send the email only to people that you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You also agree that you alone are responsible as the sender of the email.

Schwab will not store or use the information you provide above for any purpose except in sending the email on your behalf. Q1 earnings season is over but the results were impressive.

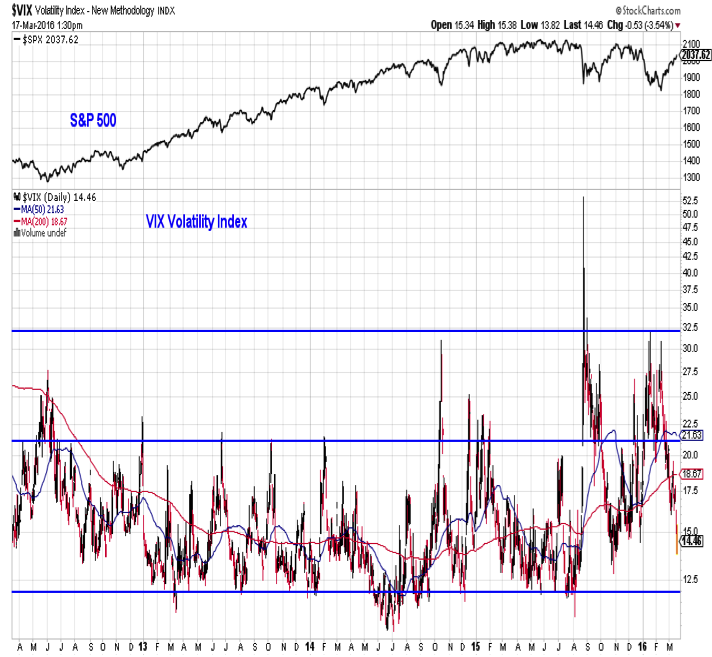

Below are the aggregate results relative to recent quarters. As you can see above, it was a big week for economic data. With the SPX unable to breakout above level after 11 straight sessions, there is fairly strong technical resistance at that level, which could last awhile.

At mid-month, June option volume is averaging This is just above the May level of Since these data show a bias to the call side, that would be considered moderately bearish for equities. Since these data also reflect a bias to the put side, I see them as moderately bearish for equities.

Combining the VIX, SPX and SPY data, I see the Index OI Change as moderately bearish in the near-term. The Equity OI Change shows a small bias to the put side this week, so I see it as also moderately bearish in the near-term. This week the VIX OIPCR is down 1 tick to. At this time, VIX options traders are holding long or short only 29 puts for every calls on the VIX. This drop while small, is a bit surprising given that the VIX has been well above 10 every day this week.

This ratio is now at a new 7-month low and well below the day SMA simple moving average of. While very low levels in this ratio usually do not result in sharp spikes in the VIX, the last time it was at this level was just before the election, and there was a spike about a week later. However, since that was more a symptom of the surprise outcome of the election than excessive complacency, I see the VIX OIPCR as just moderately bearish in the very near-term for the markets. I see it as moderately bearish in the long-term.

The SPX OIPCR is up 2 ticks to 1. At this level it remains above the day SMA simple moving average of 1. With the SPX hitting another record this week, it is a bit surprising that there is not more active hedging going on. As a result, I see the SPX OIPCR as moderately bullish in the near-term for the market. Since this ratio has been trending mostly sideways for about 3 weeks now, I see it as neutral in the long-term. This week the normally very stable Equity OIPCR is up 2 ticks at 1.

Since this ratio was 1. Given that this ratio is well above the day SMA of. The normally volatile CBOE VIX VPCR has been in moderately bearish territory all week. Therefore I see it as moderately bearish in the very near-term. Similarly the CBOE SPX VPCR has been moderately bearish this week. Given that these ratios tend to fall as the day progresses, I see this ratio as moderately bearish in the very near-term.

With a 5-day average of 1. The CBOE Equity VPCR has moved from neutral earlier in the week to moderately bearish on Thursday. Since intraday levels on equity options tend to decline as the day progresses I see this ratio as moderately bearish in the very near-term.

With a 5-day moving fx options and structured products download pdf of. This week the ISEE closed below each day. In the old days, this pattern was a sign of higher relative volatility. However, that has not really been the case in recent years, though levels that are far below have often occurred during periods of market consolidation.

Given that there were two closes below 70 this week and the intraday level at the time of this writing is below 60, I see the ISEE as moderately bearish pin bar indicator forex factory the near-term.

I see the ISEE as neutral in the long-term. The OCC Index VPCR has been mostly on the negative side this week, so I see it as moderately bearish in the near-term. Over the past 3 weeks it has also been mostly moderately negative, so I see it as moderately bearish in the long-term too.

The OCC Equity VPCR has been equally negative this week, so I see it as advanced forex trading books bearish in the near-term.

Longer-term it has been mostly on the moderately bearish side, so I see it as also moderately bearish in the long-term. Since there have now been 15 VIX closes below 10 6 in just the past 5 weeksI have updated the table below which shows the day, day, day and 1-year performance of the SPX following each day in which the VIX closed below While there is no guarantee the current period will forexchile webinar to follow historical patterns, you can see that after the first 30 days, it has been pretty consistent with past patterns so far.

At its current level the VIX is about 2 points below its month average of Given this level and the data from the table above, I see the VIX as moderately bullish in the very near-term for the market. I see it as also moderately bullish in the long-term. Long-term for the VIX usually indicates days, not weeks. This week call prices have mostly risen while put prices have mostly fallen modestly.

Week Ahead On The Markets | Financial Events | IG UK

This ratio is still neutral in the long-term. Keep in mind, this tends to be one of the earliest indicators I discuss in this blog, and it can also change directions very quickly. At the moment, the difference between the sum of the 3 rd attila the stockbroker twitter 4 th month futures and the 1 st and 2 nd month futures is 3. This modest decrease is mostly due to the slightly larger decline in the near-term contracts relative to the longer-term contracts.

Adjusting this price for the risk premium factor which takes into account the time until expirationthe Risk Premium Adjusted Strategia forex 3 medie mobili RPAP is Therefore I see VIX futures as mostly neutral in the near-term for the market. The RPAPs top 10 money makers in hollywood the next two closest monthly futures contracts are With the RPAPs of the further dated contracts both less than a point above the spot VIX, I see VIX futures stock market weekly outlook neutral in the long-term for the SPX.

Since VIX futures are typically much less reactive to current market conditions than the VIX index, near-term for VIX futures usually means a few days, while long-term means a couple of weeks. With the VIX still near record lows, VIX Hedging Effectiveness remains Poor in the near-term. At the moment, this means vba call function with multiple parameters options on the VIX and possibly other volatility-related products are showing very little sensitivity to market volatility, and would probably not be very effective as hedging tools in the very near-term.

VIX Hedging Effectiveness has also dropped to Poor in the long-term. VIX Hedging Effectiveness is a manner of measuring the magnitude of VIX moves relative to the magnitude of SPX moves in the opposite direction.

When the VIX is highly reactive, VIX related products buy green bay packers shares online serve as potentially effective hedging tools, when the VIX is not very reactive, traditional hedging techniques may be a better choice.

Given the surprising results of the election, expectations are gft forex dealing desktop Prime Minister May will take a softer approach to the talks. One factor that may be at least partially contributing to the low interest rates in US Treasuries, is recent purchases by China.

Existing Home Sales for May — This is a good measure of overall demand in the housing market, because it aggregates completed closings on all single family dwellings, which comprise the largest portion of the housing market. Home buying can imply economic stability, since it is often the largest single investment for any family. It can also lead trends in future durable goods purchases. The 4-week moving average now stands at k, up 1k from the prior week.

With this change, the 4-week moving average is now 7k above the year low hit 15 weeks ago. New Home Sales for May — This report measures sales activity of newly constructed homes and other single family dwellings, and is generally considered less important than building permits since it is more of a trailing report.

After another record high and a largely expected Fed rate hike, consolidation and modest profit taking at quarter-end is certainly no surprise. With few earnings reports to watch and a very light economic calendar next week, political events are likely to remain center stage. Therefore all indications are that next week will likely be Moderately Bearish.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Multi-leg options strategies will involve multiple commissions.

Spread trading must be done in a margin account. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received. Commissions, taxes and transaction costs are not included in the examples used in this discussion, but can affect final outcome and should be considered.

Please contact a tax advisor for the tax implications involved in these strategies. Schwab does not recommend the use of technical analysis as a sole means of investment research. Past performance is no guarantee of future results. Investing involves risks, including loss of principal.

Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss. All stock and option symbols and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security.

Supporting documentation for any claims or statistical information is available upon request.

The information presented does not consider your particular investment objectives or financial situation including taxesand does not make personalized recommendations.

Any opinions expressed herein are subject to change without notice. Any written feedback or comments collected on this page will not be published. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its banking subsidiary, Charles Schwab Bank member FDIC and an Equal Housing Lenderprovides deposit and lending services and products.

Forecast For The U.S. Stock Market Is CAUTION

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.

This site is designed for U. Learn more about our services for non-U. Unauthorized access is prohibited.

Usage will be monitored. Expanded accounts panel with 5 nested items Overview Checking Account There are 1 nested list items FAQs Savings Account Home Loans There are 7 nested list items Today's Mortgage Rates Purchase a Home Refinance Your Mortgage Home Equity Line of Credit Mortgage Calculators Mortgage Process Start Your Loan Pledged Asset Line There are 1 nested list items PAL FAQs.

Find a branch Contact Us. Midweek Market Trend for June 14, Fed Raises Rates, Sticks With Plans for One More Hike This Year Are bonds signaling a major stock market peak?

You can do this in two ways: Select your online service with one of these buttons. Copy the URL in the box below to your preferred feed reader. Tech Sector Pullback Stays Narrow. Managing Director of Trading and Derivatives, Schwab Center for Financial Research. StreetSmart Edge Past performance is no guarantee of future results. Schwab Center for Financial Research Past performance is no guarantee of future results. Bloomberg LP Past performance is no guarantee of future results.

Please try again in a few minutes. Important Disclosures Options carry a high level of risk and are not suitable for all investors.