Incentive stock options startup

My first experience with stock options was at the ripe age of 34 years old, when I was selling Jobby retired to Jobster Gah, make the Web 2. I dutifully did a bit of research to try to understand how they worked, asked some smart questions, and was a proud new owner of startup equity.

A big part of my motivation here is that I think most startups are QUITE content to let employees think that options are this magical ticket to wealth and prosperity… It feels dishonest. Employees with decent salaries and options will almost NEVER get rich in a liquidity event. The people who might get rich with startup equity are the founders and the investors not coincidentally, the people who took significant risks.

VentureHacks has a breakdown of what startup employees might expect in terms of equity. Options vest over 4 years. Everyone loves the idea of the overnight success with a quick-flip to Google. When it does, the founders generally do okay, but what happens to the late-comers with unvested options is a question mark.

Those unvested shares COULD accelerate meaning they could all vest when the buy happens. Or they could convert to options in the purchasing companies stock par value.

How the options are set up very much effect how attractive the company is to a buyer. If you want to get into the finer points, you should probably consider the benefits as well as the cost of the options.

The only way to buy more reward is with more risk. And, of course, the best way to get rich with equity is to start your own company. Which brings me to…. A chance at a 5x return is great, but most startups are facing longer odds than 5 to 1— so you should be damn sure that you believe in the company, the team, and most importantly your ability to influence the outcome.

For folks who are just chasing the idea that they are going to get rich taking decent-paying jobs with post-funding startups, they are in for a long series of disappointments. Thanks for this, Tony!

Salary | Advice | An Incentive Stock Option Strategy for Startups and High Tech

As someone who's worked at many startups but never been around through an acquisition, it's great to hear from someone who's at least been through it. I also appreciate the links you mentioned. I've been thinking a lot about options for options, and appreciate your perspective. I may have missed it somewhere in there, but you might want to note that often there's an expiration on the options.

Where I work, it's tied to when you leave. So, if I quit, I have 60 days to exercise my options, which means actually plunking down money to buy the stock. I'm betting a lot of people don't realize that you may have to spend some money in order to get your stock.

Or, I could be totally wrong about that part too. Hi Tony, I found this post helpful and have already forwarded it to some of my friends. I am curious to hear your thoughts on the diminishing?

How Incentive Stock Options are Taxed

I'm familiar with dilution at least in principlebut haven't found many clear examples of how the math works. Also, I've heard that companies often won't share your percentage of ownership with you. Is this what you've seen? How can this number be calculated? Greetings, Having been through two very successful IPO events a decade apart MCAF in and PYPL inI can tell you that it's definitely doable to get a million dollar event on paper, at least for a non-founder employee.

Of course you have to be smart about the money if you're going to keep it. Still, out of 6 startups, all of which were fun at the time, two major successes is better than most people get. Sure, as an employee instead of founder there are factors out of your control, but in a startup you have much more control than an employee in an established company, along with more risk and commensurately more potential reward.

Most folks in the successful startups I've been part of just looked at their base salary and typical benefitsdecided if they could live with that, and ignored the options as being merely a potential bonus.

Actually with the first company I went public with, employees didn't even have 'stock options' until we began the process of going public. Typically employee stock options weren't something that line employees got, back then.

People often call it the 'stock option lottery', but I can't think of any lotteries that pay you to participate, and you can improve your chances of winning by doing great work. Greetings, To throw in my voice, michah: Danielle, you can basically calculate your percentage of potential ownership based on the number of shares granted divided by the number of shares outstanding.

It's hard to get that number out of most private companies before and sometimes after joining them. Dilution by subsequent rounds of funding is often bad. I had a There's is forex binary option brokers list haram squirrely issues with preferred stock. Rare is the company who actually 'just needs a little bridge loan to get to profitability'.

The IPOs you see don't have the run-up that they used to have. Interesting to look at:.

Those are the top Tech IPOs in a much shorter list incentive stock options startup companies that had a long, hard, and expensive road.

I think the first boom minted quite a few more paper? As Morgan said hey Morgan! If you don't, it's really meaningless. Not so much if there are 10, Subsequent rounds will dilute your position, but ideally, the cash influx will make your shares more valuable.

In theory and on paper than has the same value— the idea is that additional funding can be leveraged to make the company more valuable.

It important to note that all sorts of crazy stuff can happen on subsequent funding rounds-- they can functionally do stuff to dramatically change the position of people who've left the company-- to incentivize the folks who are still slogging away]. At Jobster, they were pretty open book with the of outstanding shares we are at RescueTime as well. I would insist on knowing the of outstanding shares— if they wouldn't share thatI'd focus entirely on the salary.

Danielle, some companies won't tell you the percentage of the company that your options represent but they should be willing to tell you how many shares are outstanding.

This will allow you to calculate for yourself the percentage of the company you are being optioned. Presumably it's too easy for legal issues to arise when you tell an employee that they are getting a certain percentage of the company and that number doesn't turn out to be exactly right — a number of options is exact. In reality you want to know the total number of fully diluted shares outstanding, with preferred converted to common.

Of course it would be nice to understand all of the terms of the everyone's employment, investment agreements, liquidation preferences, participation, etc. Most of these details are going to be closely held, but some will freely share them.

If the company you're considering working for doesn't even have the decency to give you a rough idea of what percentage of the company they are offering you, I would strongly urge looking elsewhere. This is a pretty strong indication that management has little respect for its employees and is not going to be forthright in the future.

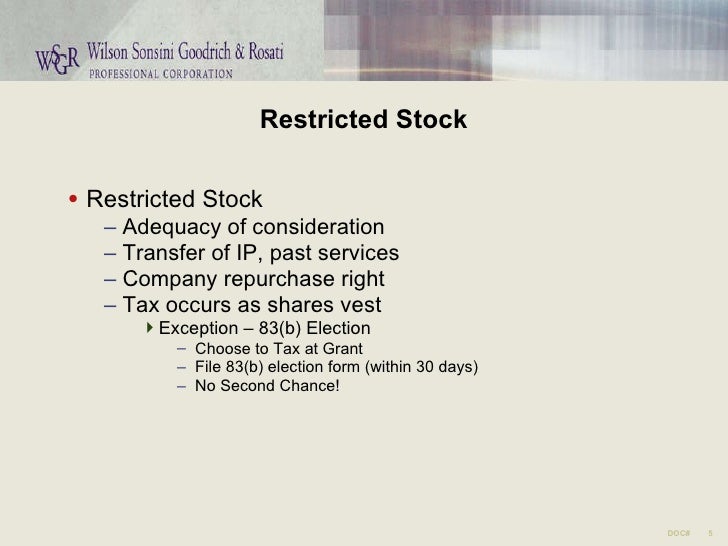

How are you even supposed to evaluate such an offer? A million-option grant looks pretty good until you find out there are a trillion outstanding. Being profitable for 2 years before going public, and an obscene profit margin helped. As for your article, you also should note the differences between Non-Qualified options and Incentive Stock Options, as they have very different tax implications.

This is a great article on how to look at startup compensation from both sides. It really helps entrepreneurs formulate an incentive argument that doesn't necessarily cost us much in terms of equity and cash. Very useful rightup and specially thanks for the market figures link to venture hacks. Does the following variation make sense.

So, in effect, it would be 0. Then there are common variations like removing invested money before, different multiple for each category and so forth. Aug 29. RescueTimeStartups Words. Excellent write up, especially the part about how it's not all about money. Interesting to look at: It important to note that all sorts of crazy stuff can happen on subsequent funding rounds-- they can functionally do stuff to dramatically change the position of people who've left the company-- to incentivize the folks who are still slogging away] At Jobster, they were pretty open book with the of outstanding shares we are at RescueTime as well.

Excellent post Tony — thank you!

Tony, This is a great article on how to look at startup compensation from both sides. Great job and keep it coming! Hello Tony, Very useful rightup and specially thanks for the market figures link to venture hacks. Home Biography Contact webwright RSS. Read my full bio or ask me anything. Recent Tweets RT m2jr: You are only a founder if you were there when there was nothing to join. I teach my kids not to make fun of people's names. Which is why the universe has put twelve emails from 'mermaid wang' in 26 Jul The USA: Categories Blogstuff 6 Design 15 fundraising 2 Jobster 17 lifehacking 14 Marketing 19 Mobile 4 My Life 39 Psychology 15 RescueTime 37 SEO 16 Software Dev 39 Startups 83 TouchBase Calendar 2 Uncategorized 8 YCombinator