Major players in forex market

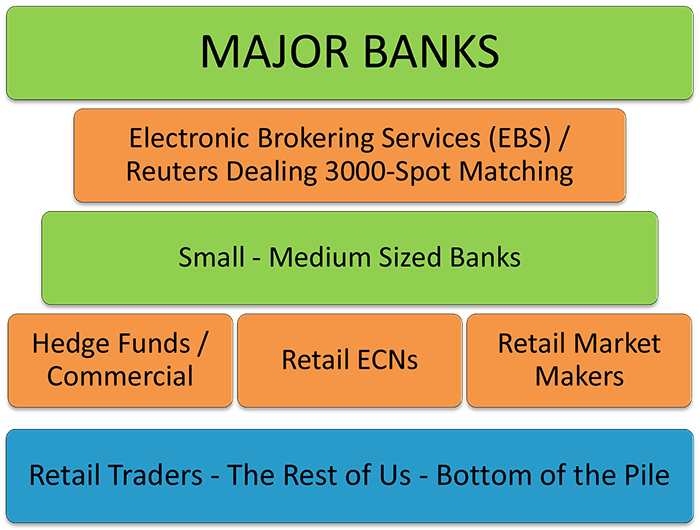

If you have any questions or suggestions you are welcome to join our forum discussion about Major Players in Forex and Styles of Trading. After we have learned the basic terms in Forex trading, now the time has come to talk about who participate in the Forex market. We could categorize major players in the market in six groups:. First, commercial and investment banks are the foundation of Forex market, as all other players must deal with them in order to participate in the market.

The mechanics of order processing in currency exchange, in which banks play the main role, will be explained in the next article.

Second, central banks are also major participants, but they are separated from commercial and investment banks, because of the different goal they are after when exchanging foreign currencies. Their main purpose is to provide adequate trading conditions in their home countries, controlling the availability and money supply.

They also intervene in the Forex market at times of economic and financial imbalances, when fluctuations of the national currency need to be dampened. The third group encompasses high-net-worth individuals, who usually participate on the Forex market through the intermediation of commercial and investment banks. A high-net-worth individual is a person with high net worth.

Forex4you: Online Forex, FX, Commodity and Currency Trading 24/5

Another group consists of hedge funds, which are a relatively new player on the currency exchange markets. They comprise high net-worth individuals that work in a partnership and have very large pools of investments, in most cases totaling well above hundreds of millions of dollars. They are mainly driven by the needs of their business operations, during which often payments for goods and services in foreign currencies arise and require an exchange.

And the last group of participants consists of individuals. These are mainly people who need to exchange some of their home currency for another, most often when they are visiting a foreign country and need to pay for goods and services in the local currency.

Now that we have mentioned the main participants in Forex, it would be useful, if we focus our attention on different Forex trading styles.

Before starting your experience as a trader, you should know the specifics of behavior of different types of traders and decide which style of trading you wish to implement.

Generally, several different trading styles can be distinguished: Day traders can be institutional or private. Institutional day traders work at financial institutions and have a number of advantages over private traders, such as access to more resources, tools, equipment, large amounts of capital and leverage, large availability of fresh fund inflows to trade continuously on the markets, dedicated and direct access to data centers and exchanges.

On the other hand, private traders work as a freelancers, or in a partnership with a few other traders. In the United States, for example, day traders may not advertise as advisors or financial managers. Although not required, almost all private day traders use direct access brokers, as they offer the fastest order entry to the exchanges, as well as superior software trading platforms.

Day trading is a short-term trading style, because it implements analysis of charts with a time frame of 15 minutes, 30 minutes or 1 hour. A day trader usually spend hours per day of trading and strive to achieve a quick turnover rate.

These traders tend to rely more on technical analysis, taking advantage of small price movements, and trade highly liquid currency pairs in order to profit. Scalping is a style, which includes very intensive, quick trading. If a trader leaves a position open for more than 1 minute or two, then such a style is no longer considered as scalping, but rather as day trading.

There would not be any point in scalping for many traders, if they were not offered to trade with highly leveraged trading accounts. Only ability to manage a huge amount of funds of, actually, virtual money, provides these traders with the opportunity to profit from a price move of a mere pips.

In doing so, scalpers tend to examine charts with a time frame of 1 minute to 15 minutes.

Forex Masters - Excellence in Training

Thus, swing trading is based on a time span longer than day trading, but also shorter than the buy-and-hold strategy, which includes holding positions open for months, and even years. A swing trader usually enters into an average of 3 to 6 trades within one week and strives to make a large amount of pips in profit, to pips. These traders utilize the longest time frame of trading in comparison with the other three groups.

In this case traders may enter into trades, lasting for several weeks to several months. The main purpose here is to register a large amount of pips per trade, from to pips. These traders usually prefer to use fundamental analysis or examining macroeconomic, political or other indicators , when making their decisions.

Founded in , Binary Tribune aims at providing its readers accurate and actual financial news coverage.

Forex Tutorial: Forex History and Market Participants

Our website is focused on major segments in financial markets — stocks, currencies and commodities, and interactive in-depth explanation of key economic events and indicators. Trading forex, stocks and commodities on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our Privacy Policy.

Wednesday , June 21st. Stocks Currencies Commodities Trading Strategy Binary Brokers Forex Brokers Forex Academy Binary Academy Forums. Major Players in Forex and Styles of Trading This lesson will cover the following Who participate in the Forex market What time frame can investors use in order to trade. Major Players in Forex Forex Brokers and Where They Fit Market Players and Classification.

Using an Economic Calendar What is a Chart? Types of Charts Types of Orders — Forex Market. Table Of Contents Introduction to Forex Trading Introduction to Trading and Speculative Markets Supply and Demand in Trading Types of Financial Markets What Does Forex Stand for?

Forex Trading Terms Advantages of Forex Over Stocks Major Players in Forex and Styles of Trading Forex Brokers and Where They Fit in the Market Types of Market Players and Classification Why Using an Economic Calendar is Important? What is a Chart? Types of Charts Types of Orders in the Forex Market Trading Derivative Instruments I Trading Derivative Instruments II What is leverage?

What is a Margin? Advantages of Using a Demo Account What to Look for in a Trading Platform? Trading Sessions Asian Trading Session European Trading Session North American Trading Session Which Trading Session to Choose? Fundamental Analysis Fundamental Analysis - the Basics Monetary Policy and How it Impacts the Value of Currencies Inflation and Interest Rates Reserve Requirements of Banks Open Market Operations Monetary Aggregates Gross Domestic Product GDP Labor Market and Its Significance Retail Sales and Personal Consumption Expenditures Housing Market Consumer Price Index and Producer Price Index Current Account, Balance of Trade Purchasing Managers' Index PMI Economic Sentiment Factory Orders, Industrial Production Monetary Policy Announcements and Verbal Interventions Political Events, Natural Disasters, War Money Management Money Management and Risk Money Management Risk Concepts How to Reduce Risk in Trading via Protective Stops Trailing Stops in Forex Other Kinds of Stops - Signal, Time, Targets, Execution Scaling in and Out of Trades How to Choose the Right Leverage?

Correlations Within the Forex Market Why are Trading Journals Important Trading Psychology The Importance of Psychology in Trading Becoming an Accomplished Trader Market Sentiment - the Basics Crowd Behavior and Going Against the Public Recency Bias and Its Influence in Trading Technical Analysis Introduction to Technical Analysis The Trend - a Trader's Best Friend Support and Resistance, Part I Support and Resistance, Part II Pivot Points Breakouts Throwbacks and Pullbacks Channels Retracements Introduction to Moving Averages Simple Moving Average Exponentially Smoothed Moving Average Moving Average Crossover Moving Average Convergence Divergence Average Directional Movement Index Parabolic SAR Rate of Change Stochastic Oscillator Relative Strength Index Commodity Channel Index Market Facilitation Index Bollinger Bands Standard Deviation Indicator Average True Range Patterns Including One Candlestick.

Doji Candlesticks Patterns Including Two Candlesticks Patterns Including Three Candlesticks Double Top and Double Bottom formations Head and Shoulders Pattern Symmetrical, Ascending and Descending Triangles Wedges Price Pattern Rectangles Price Pattern Flags and Pennants Price Pattern.

Stock News Currency News Commodities News Trading Strategy. Forex Trading Academy Binary Options Academy Price Action Trading Academy Social Trading Academy Advertise Day Trading Academy Forex Trading Strategies Technical Forex Trading Indicators MetaTrader 4 Guide Forex Trading Mentoring Program About us Currency Pairs Trading Strategies Authors Privacy Contact us Jobs Forex Brokers Comparison Binary Options Brokers Comparison Forex Rebate Program.