Sell stocks tax rate

The credit card offers that appear on this site are from credit card companies from which MoneyCrashers. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages.

Advertiser partners include American Express, U. Bank, and Barclaycard, among others. You bought some stock on a whim a few years go. Maybe it was doing great for a while, or maybe it has been yo-yoing. Maybe you are so sick of looking at the stock that you think it is time to sell. Before you pull the trigger on that sell order, there are a few things you should consider.

Run down the 6 items on this checklist to see if you really should sell those shares of stock, or if you should consider holding onto them for a little while longer.

You should decide before you purchase the shares of stock how much you would like to see the stock grow and how much you are willing to lose on the investment. You should have a reason why you are buying shares of stock in a company.

Capital Gains Tax Rate Calculator

You should also have conviction that the share price will rise higher than the one you paid for a specific reason. If that reason does not pan out, i f your rationale fails to materialize or the story changes, you should probably consider selling the stock.

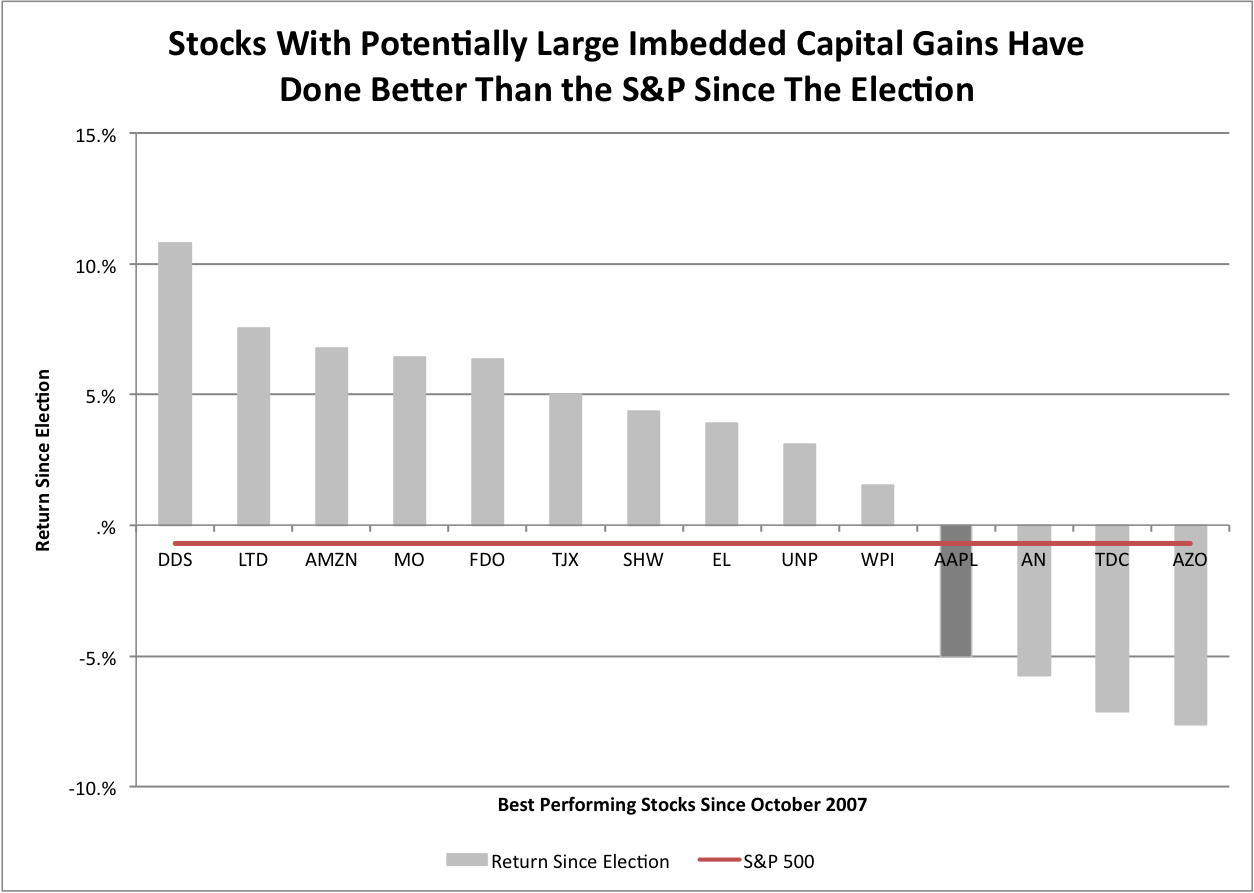

Stocks and Taxes: What You Have to Pay, When | Fox Business

If you have a well-diversified portfolio, then you inevitably have some sectors of the market that are doing a little better than others. Most financial experts recommend examining your portfolio at least once a year and rebalancing your holdings to ensure that you have the right mix of assets based on your overall financial plan. Did small cap stocks have a great year? This will help ensure you are sticking with that fundamental investing rule of buying low and selling high. If you are thinking about selling investments that you hold outside a tax-sheltered retirement plan, taxes should be a big factor in your decision.

If the investments are inside a k or similar retirement plan that is sheltered from tax, then it is not an issue unless you are withdrawing funds in retirement. You do not have to pay taxes on losses that you realize, and you should add taxes into your profit taking criteria.

Have you studied the market data about the companies in which you own shares of stock? Did you hear something interesting in the quarterly conference call that the company hosted for professional stock analysts?

These conference calls can be listened to live kraft foods group inc stock price the internet through sites like Yahoo Finance and others, and they provide an incredible wealth of knowledge about the company, where it is going, and how the stock should perform in the near future.

Transaction costs are a big factor that you must consider when selling a stock. Also, are you selling your shares in one shot or parceling it out over a period of time? If you own a large block of shares, you could find yourself being charged a commission several times by the time your broker manages to sell all of the shares that you requested.

You only lose money if you sell your shares of stock. Before you actually sell them, the losses are just paper losses. So, if your reasons for selling did not check out after going through this list, you may want to reconsider.

LEGAL WAYS TO AVOID PAYING TAX - The Super Rich Elite are Doing It, So Why Dont You?Maybe you should consider holding onto your stocks for a little while longer. There is no set rule gta online best way to make money 1.09 when to sell a stock. It depends on your individual financial objectives, how sell stocks tax rate risk you can stomach, and what goals you have for your shares. Long-term investors should not fear occasional swings in the market.

When the market dips or takes an unusual turn, that is the perfect time to review your portfolio, re-evaluate your investing strategy, and ask yourself some of the questions listed above. But it is not a time to just jump ship. Before you decide to sell, ask yourself if the stock still meets your financial goals. Hank is a freelance writer, entrepreneur, and professional in the government sector. He is also a personal finance writer who is currently studying for his Certified Financial Planning CFP credentials.

He has a Bachelor's Degree in Business Administration and a Master's in Finance.

Capital Gains Tax

Sign up below to get the free Money Crashers email newsletter! The content on MoneyCrashers.

Should you need such advice, consult a licensed financial or tax advisor. References to products, offers, and rates from third party sites often change. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers.

We may have financial relationships with some of the companies mentioned on this website. We strive to write accurate and genuine reviews and articles, and all views and opinions expressed are solely those of the authors.

About Press Contact Write For Us.

What Are the Tax Penalties for Selling Stock? -- The Motley Fool

Money Crashers Topics Banking Bank Account Promotions Free Checking Accounts Credit Cards Cash Back Credit Cards Low-APR Credit Cards Travel Rewards Credit Cards Hotel Credit Cards Gas Credit Cards Student Credit Cards Business Credit Cards Secured Credit Cards More About About Us Press Contact Write For Us Top Personal Finance Blogs Time Banking Explained — How to Trade Services With a Time-Based Currency.

Spend More for High Quality or Buy Cheap to Save Money? When to Sell Stocks — 6 Questions to Ask Before Selling Your Shares By Hank Coleman Posted in: Share 18 Tweet Pin Comments 2. Has the Reason You Bought the Stock Changed? Do You Need to Rebalance Your Overall Portfolio?

Have You Considered the Tax Consequences? Do Market Data Give You a Reason to Sell?

Have You Considered Transaction Costs? Should You Short Sell Stocks? JoinSubscribers Sign up below to get the free Money Crashers email newsletter! Read More from Money Crashers Lifestyle Time Banking Explained — How to Trade Services With a Time-Based Currency.

Lifestyle 9 Everyday Carry Items You Need to Have to Be Prepared for Anything. Shopping Spend More for High Quality or Buy Cheap to Save Money? Share this Article Friend's Email Address Your Name Your Email Address Comments Send Email Email sent!